FREE INITIAL CONSULTATION

CALL TODAY

754-900-6545

HAVE A QUESTION ABOUT YOUR MORTGAGE?

Office: 754-900-6545

Greg Light, Esq.:

greg@lightgonzalezlaw.com

Cell: 954-336-3532

Anthony Gonzalez, Esq.:

anthony@lightgonzalezlaw.com

Cell: 954-809-4421

Click Here to Read About Our Retainers

Read All Our 5 Star Reviews on:

Plantation Florida Mortgage Lawyers

At Light & Gonzalez PLLC our lawyers will carefully examine your mortgage to determine exactly what your rights are. Our attorneys have a lot of experience examining the different forms of mortgages people have signed over the years and can quickly assess whether or not the noteholder or servicer has taken all the necessary steps they needed to take prior to foreclosing. Homeowners have a lot of options when they are facing a foreclosure. At your free consultation with our firm we will begin to develop a plan of action for you and your family going forward. If we believe you have a chance of winning your foreclosure case, we will tell you. If we believe you are better off exploring loss mitigation options, we will tell you. If we believe you might want to consider bankruptcy, we will tell you. Contact us today and we will explore all of your legal options.

HOW CAN WE HELP YOU?

CONTACT US TODAY TO SPEAK TO A LAWYER ABOUT YOUR MORTGAGE

Mortgages Provisions throughout the United States

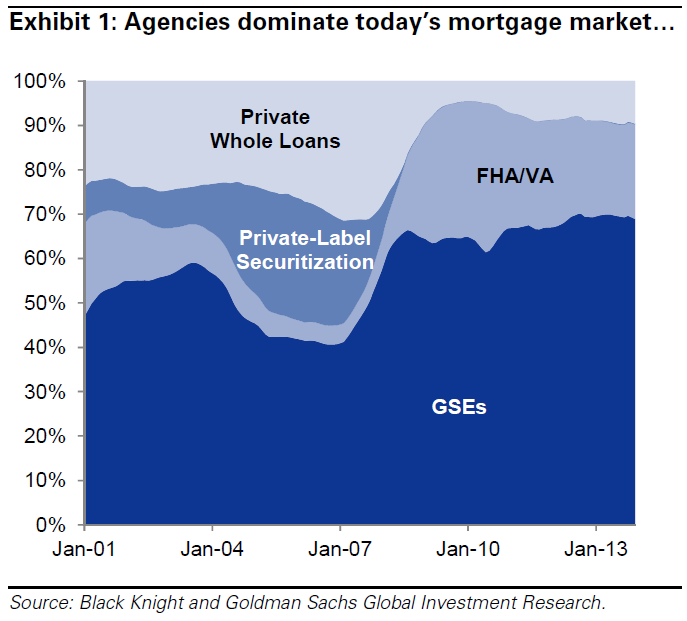

Mortgages throughout the United States are very similar. Depending on how your home purchase is being financed will largely determine which form of mortgage you will be offered. In order for Fannie Mae or Freddie Mac to underwrite a loan the loan must meet certain requirements and therefore tend to be in the same form. Federal Housing Administration (FHA), Veteran’s Administration (VA), United States Department of Agriculture (USDA) and Rural Housing Service (RHA) all have there own requirements for funding as well. Each one of these mortgages will have different types of protections for borrowers, and can be worded differently, but chances are your FHA Mortgage is going to look exactly like your neighbor’s FHA Mortgage. Below is a brief overview of just a few of the most common mortgage loan provisions than may be contained in your mortgage.

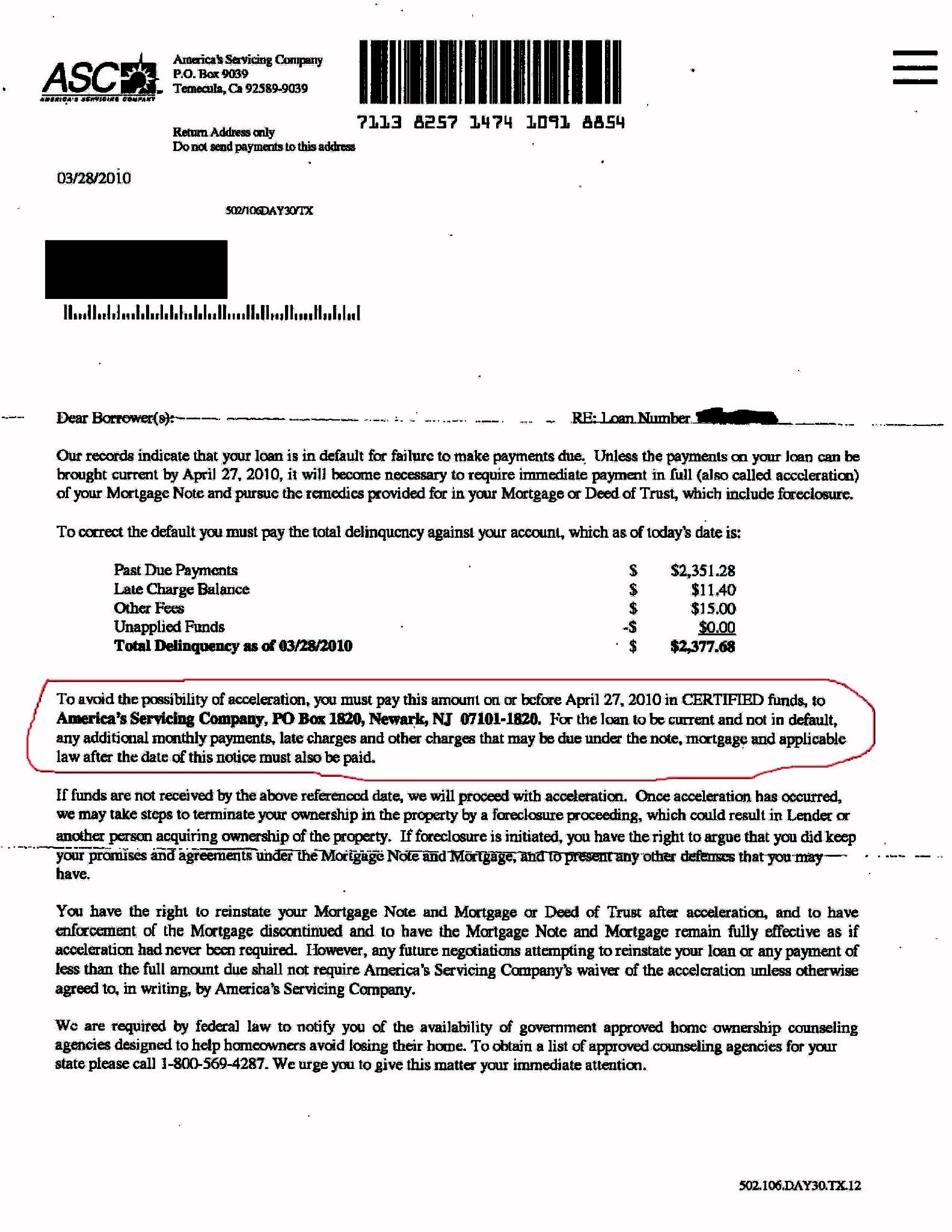

Acceleration Clause (Commonly Paragraph 22)

Almost all mortgages have a provision allowing the noteholder to accelerate all amounts due under the note if certain conditions are met. Typically the mortgagor will have to have defaulted, a notice must be provided to the borrower to let them know that the bank is exercising their right to accelerate all the amounts due, and the borrower must be given an opportunity to cure the default. The provision is most often found in paragraph 22 of the mortgage and reads:

22. Acceleration; Remedies. Lender shall give notice to Borrower prior to acceleration following Borrower’s breach of any covenant or agreement in this Security Instrument (but not prior to acceleration under Section 18 unless applicable law provides otherwise). The notice shall specify: (a) the default; (b) the action required to cure the default; (c) a date, not less than 30 days from the date the notice is given to Borrower, by which the default must be cured; and (d) that failure to cure the default on or before the date specified in the notice may result in acceleration of the sums secured by this Security Instrument, foreclosure by judicial proceeding and sale of the Property. The notice shall further inform Borrower of the right to reinstate after acceleration and the right to to assert in the foreclosure proceeding the non-existence of a default or any other defense of Borrower to acceleration and foreclosure. If the default is not cured on or before the date specified in the notice, Lender at its option may require immediate payment in full of all sums secured by this Security Instrument without further demand and may foreclosure this Security Instrument by judicial proceeding. Lender shall be entitled to collect all expenses incurred in pursuing the remedies provided in this Section 22, including, but not limited to, reasonable attorneys’ fees and costs of title evidence.

Courts throughout Florida have found that so long as the mortgagor substantially complies with these requirements the noteholder can bring an action to foreclose on the mortgage.

FHA Acceleration Provision

FHA mortgage notes contains a different type of acceleration provision that requires the noteholder to take additional steps pursuant to then exisiting Housing and Urban Development (HUD) regulations. The following provision is found in many FHA notes and mortgages:

If Borrower defaults by failing to pay in full any monthly payment, then Lender may, except as limited by regulations of the Secretary in the case of payment defaults, require immediate payment in full of the principal balance remaining due and all accrued interest. . . . This Note does not authorize acceleration when not permitted by HUD regulations. As used in this Note, “Secretary” means the Secretary of Housing and Urban Development or his or her designee.

Emphasis added. The HUD regulation that affords significant protections to homeowners who have defaulted on their mortgage payments is:

(b) The mortgagee must have a face-to-face interview with the mortgagor, or make a reasonable effort to arrange such a meeting, before three full monthly installments due on the mortgage are unpaid. If default occurs in a repayment plan arranged other than during a personal interview, the mortgagee must have a face-to-face meeting with the mortgagor, or make a reasonable attempt to arrange such a meeting within 30 days after such default and at least 30 days before foreclosure is commenced.

Unlike the notice letter sent pursuant to paragraph 22, courts in Florida have construed this regulation strictly. If the noteholder does not undertake to have a face-t0-face interview with the mortgagor or make reasonable effort to arrange such a meeting then the noteholder cannot foreclose. If the noteholder does initiate a foreclosure action without having or attempting to have the face-to-face meeting then the foreclosure lawsuit could may very well get dismissed.

Contractual Attorneys Fees Provision

Every mortgage that our firm has seen provides that if the lender or noteholder has to bring an action to enforce the note agreement then the lender is entitled to reasonable attorneys fees. In fact, this attorneys fee provision is written into paragraph 22 above. The notes do not tend to allow for the homeowner/mortgagor/borrower to have their attorneys fees paid for if they have to bring litigation though. Fortunately, in Florida Fla. Stat. 57.105(7) states that if a contract provides for prevailing party attorneys fees to one side, so too will the other side be awarded their attorneys fees if they prevail.

Recent case law in Florida may limit the application of this statute in mortgage foreclosure cases, but if a case is dismissed for failure to abide by any of thee aforementioned conditions precedent, the borrower should be able to recover their reasonable attorneys’ fees under this statute.

Contact our Plantation Florida Lawyers Today

Mortgage documents are largely the same, but if you are facing foreclosure, or any other issue involving your mortgage, it is important that you speak to a lawyer familiar with analyzing these complex document to ensure that your rights are fully protected.

Contact us today to schedule a free initial consultation.

REQUEST A FREE CONSULTATION

Fill out the form below to receive a free and confidential initial consultation.